For the past four years 2021-2024, 77 students, mostly from lower socio-economic, first generation backgrounds have completed a set of educational and information sessions about financial literacy with a specific focus on investing at an early age in planning for retirement. The unique model that these students completed provided each student with immense knowledge about investing in stock and non-stock vehicles as many of these students come from families who are unfamiliar with investing strategies and retirement planning. In surveys given to students when they completed the investing sessions, the overwhelming response was that they have now addressed two very common reasons why many people have little to no funds saved for a comfortable retirement: (1) The fear of losing all their money and (2) The lack of knowledge about common sense practices on investing.

The very interesting and exciting aspect for many of these students is that they have now continued to invest small portions of their earned income into these powerful long- term investment programs! Students are given engaging information in the form of hands-on examples and understandable graphs and charts that illustrate the concepts that are presented in the information sessions. Students remark that they still remember several of the personal examples given even 2-3 years after completing the sessions. These examples are designed to serve as guide posts for students when they think about the amazing impact of the compounding of money, asset allocation, diversification, hidden expenses in investing and in the calculation of returns on investment through the years. Students are given handouts and calculation templates that focus on rational and logical investment strategies as opposed to decisions based on emotion.

The following are just a sample of quotes from students who completed the investing sessions:

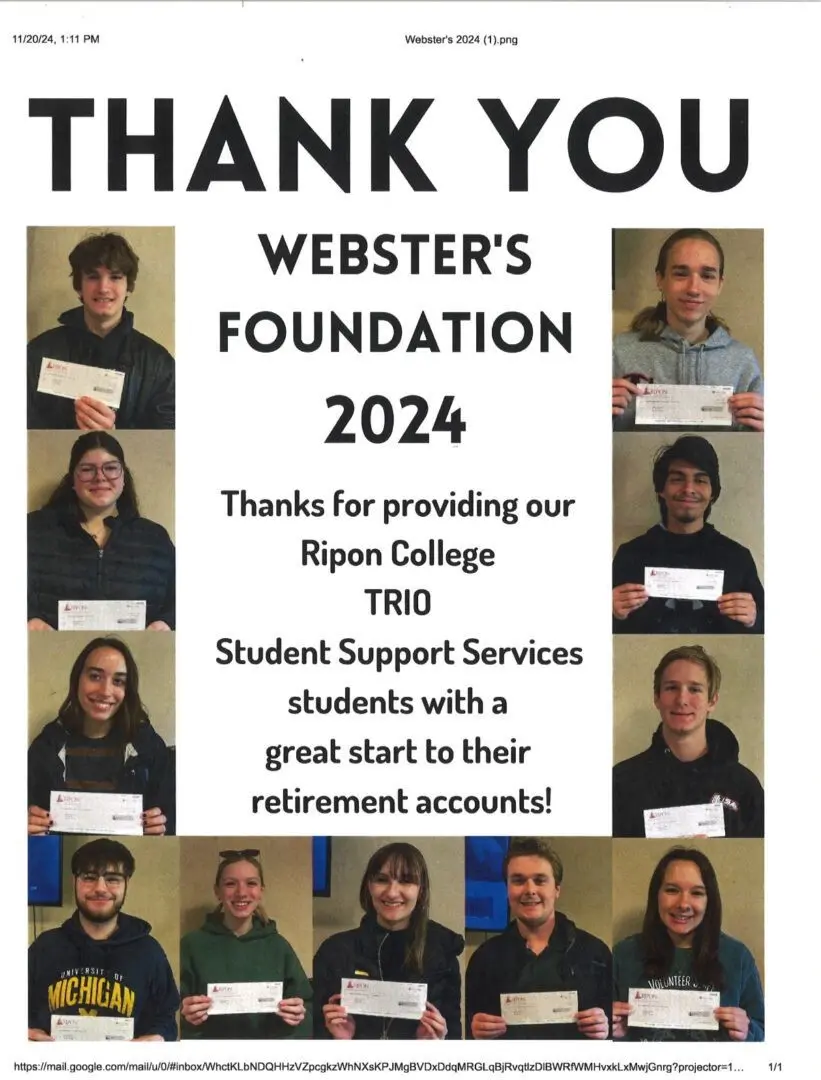

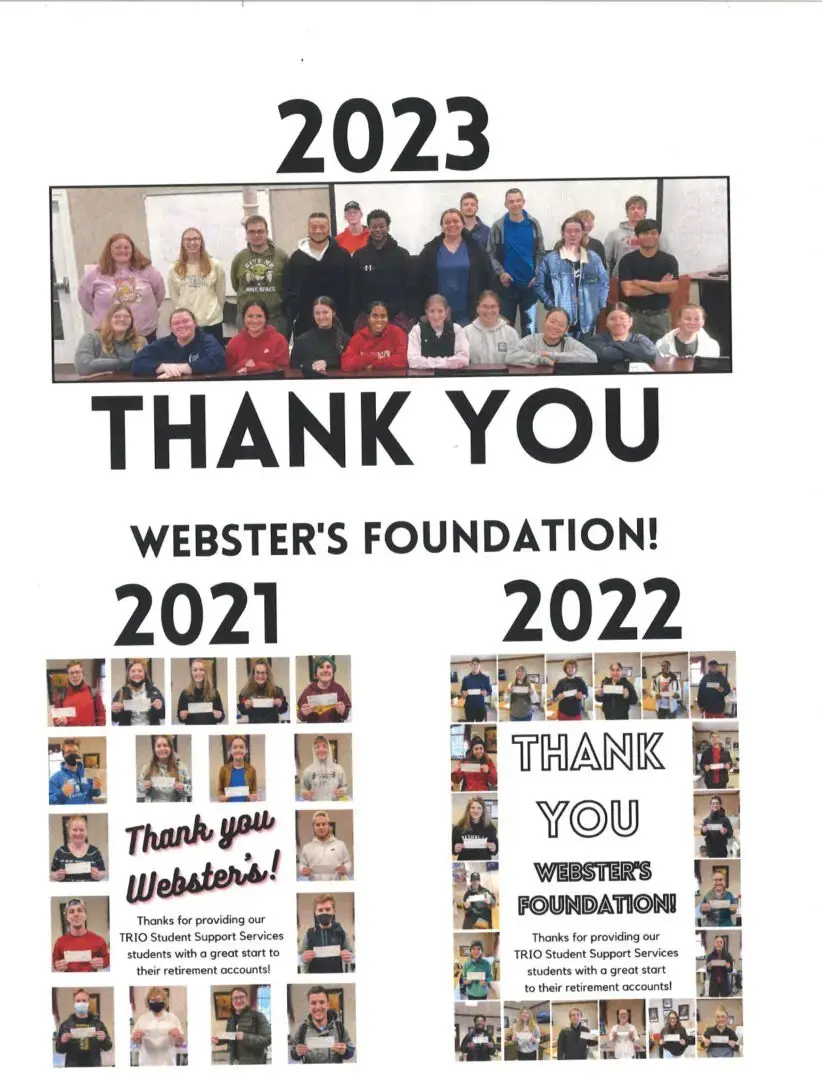

The pictures on the site show students with the checks they received through a local foundation for completing the sessions with this money being used to invest in a certain configuration in a retirement account. The information the students have been exposed to has persisted and the actual money made the sessions much more real for the participants.

This financial literacy and investment and educational model has demonstrated that young students all over the country can benefit with this knowledge being a powerful factor in financial equity and wealth accumulation, especially for under-served populations. Contact Dan Krhin at www.capstone-consulting.org or at [email protected] or at (920) -279-2466. To discuss details about dates and costs.